Buy and keep what you love. Sell the rest.

It’s not Chinese, but I bought it because I loved it. Japanese Kakiemon and Lacquer Charger Edo period. Authors collection.

15th C. Longquan Ming Incense Burner, bought is years ago, loved it then and now. Authors collection.

Song Black Glazed vase, a GEM. Bought from a small auction house in upstate NY. Ex-Cornell Univ. Collection. Authors collection.

Late Ming Cizhou pottery jar. Bought during the 1980’s ex collection of American Artist Joseph Lindon Smith, 1863-1950. Not terribly rare, but very well done. Authors collection.

Investing In Chinese Art and Antiques, or Collecting Chinese Art

A few thoughts on the idea of "investing in Chinese Art" and Art in General

Players in all art markets are comprised of six basic groups.

- True Collector Who buys only for the love of the objects and history.

- Investor Who buys everything purely for speculative gain.

- Collector-Investor People who primarily collect and occasionally buy and sell other objects to finance their collecting.

- Dealer-Collector A true lovers of art, often many areas, but also buy and sell to other collectors.

- Dealer It's just a job.

- Dilettante Collector Who buys for social status and financial gain.

Are you a TRUE Collector or Investing in Chinese Art? (excluding Dealers)

Investing in Chinese art or any type of art or antiques has always seemed to me to be a rather dubious and contradictory pursuit if you do so with the idea of calling yourself a true collector. Investor or Collector? It all begs the question, are you "collecting" to be pleased by objects, their history and beauty or are you really building an investment portfolio posing as a collection?

Which motivation comes first for you? Love of the object or a desire to make money? They are not one and the same on any level beyond the fact both require making a purchase.

True collecting by its nature, should draw the individual to objects that strike a chord and are fascinated by the object itself on many levels. Collecting demands an appreciation of an objects creation, historical context and an understanding of quality and beauty at a deeply personal level.

Investors or speculators typically take these considerations into account as an afterthought in most cases if ever. This is not to say, a collector who comes across a very valuable object at a bargain price it should be passed over. After all, making a quick bundle on an overlooked item once in a while is a great way to FUND your true area of interest. The trick comes with keeping to two activities separate in your mind. Buying something that's potentially worth a huge amount of money that you're not in love with and then sticking it in your home or warehouse is not collecting, it is wealth accumulation.

Investment or a Collection?

Collectors who start looking primarily at available items with an eye towards its profit margin upon being sold regardless of its personal appeal and fascination are no longer collectors. It's ok to do, as long as you recognize you're not hunting things down for the same reason you initially got involved anymore.

Once the importance of long or short term financial considerations come first, the focus of the one time collector inevitably changes and it becomes a job.

The difference between the art Collector and Investor is simple.

Both require an understanding and appreciation of the object in either case, but only a collector will love and covet an object with little thought of its monetary value once purchased. To do both well is very tough, it demands a huge amount of personal discipline and complete self-awareness as to why a given purchase is made. It also requires years of study, a very good memory, an innate sense of taste and deep appreciation for your area of interest. If the collector is incredibly disciplined and self-aware, it can be done but in rare instances. Those who succeed sometimes become full-blown dealers who buy and sell to supplement their collecting habit and to replace their income from a none related occupation.

Either way it requires buying smartly, learning how to buy online without getting stuck with fakes and taking the time to do your due dillegeance.

NOTE: Some investors never bother to learn much of anything but rely on advisors and gallery owners to steer their decisions. Smart collectors also work with dealers to learn and to be exposed to things they might not ever see elsewhere. Great dealers prefer the latter over the former every time.

The Collector Dealer

I have been a dealer, appraiser and auctioneer for decades as well as a collector of many types of things. However, I have NEVER bought anything as a dealer that I didn't have a plan for reselling the moment I made the purchase. The things I buy as a collector have always and only been bought to be made part of my life, my collection and to enrich our home environment. I've always done this regardless of whether or not a handsome profit could be made by selling it. This type of bicameral pursuit requires discipline and is not easy to do. Typically, the only time I've sold things from my collection is when I've been able to replace it with a much better or more interesting example that makes the old piece redundant.

Over the years I've known a large number of good dealers who also collect in a disciplined way, they help collectors pursue their own interests while squirrelling away things they personally enjoy. They are the happiest of all dealers as well typically. As for me, I've never thought about investing in Chinese art or any art beyond what I buy and sell as a dealer, I've never held back anything as a pure investment. I I personally don't love it, I just sell it and put any extra money into the DOW, S&P or NASDAQ.

I should point out, many dealers in the art and antique world collect nothing in particular and a visit to their homes would tell you nothing about what they do for a living. They have no love of the objects they sell, but are just knowledgable enough and can earn a living from the trade. As an aside, over the years I've made some great additions to my own collection and my inventory from these dealers as they often miss aspects on objects that set it off from being just "another piece" and is a great rarity.

Is Chinese Art A Good Investment? How About Art in General?

When viewing the history of the entire art and antique market in total from a financial standpoint you'd frankly be better off with a DOW index fund. After all, art in general and for lack of a better word "collectable Art" have not been particularly reliable when it comes to Return on Investment or ROI. Sure some classifications or types of art have increased in value steadily for many decades, but, many more have not and instead declined heavily in value.

Those Rothkos bought in the 1980s for a million or a million and a half dollars today are worth around 25 to 40 million or more, not bad. Then you have a lot of other Modern, Old Masters, and Impressionist art that has not fared so well over the years. Not to mention that American Newport chest that sold for $2.5 Million in the 1990's and is today worth 50% to 60% less. There are many examples like this.

Art Markets Can Lose A Lot Of Value

Once an area of the art or antique market is driven more by "investors" be they dilettantes of just financially motivated buyers and less by true fans and collectors, you're on very thin ice financially. Initially, collectors create the FLOOR and main strength of any art or collectors market. Eventually, investors show up and push the price ceilings hoping the collectors and other investors will follow along. Inevitably investors become the dominant force price-wise at the top of hot art markets, over time prices become unsustainable and often end up crashing or just flatlining price-wise.

The proof of this is when a longstanding carefully created collectors collection comes to the market, whether it's via an auction or through a gallery, massive checks invariably get written. Hit and run collections formed over the course of a decade or two often meet resistance if the collector is generally viewed as a speculator. The Chinese are market has a lot of these "collectors".

A Bit More About Dilettante Collectors-Investors

All art markets including Chinese and Asian art have or have had their dilettante collectors. They are attracted to collecting in "hot markets" to make a profit and often to gain higher social status. Many are financially well off and are seeking additional ways to move up a few steps on the social ladder in their quest for validation. They buy because others are buying whom they hope will view them through their own collections as social-cultural equals. This interest in art typically evaporates at the speed of light once the art market they are buying into collapses or prices rise so high they cannot resist taking the money and cash out.

For example, when the prices in the Japanese art collapsed in the late 1990s, a huge percentage of self-proclaimed collectors vanished almost overnight. The same thing happened during the early 20o0's when the early American antique market went off a cliff into oblivion. The actual few TRUE collectors remained behind, buying up the newly devalued objects that had for many gone beyond their reach during the BOOM in both markets. The dilettante collectors moved onto other things like rare wine, exotic cars the latest FAD in the art world. The American Modern Art market is fraught with these buyers who seek trophies for walls and portfolios with little deep and abiding interest in what it is they are buying.

Great TRUE Collectors Always Win

The fact is, the folks who historically have made the biggest financial gains in the art world are the true lifelong collectors. Most never intended to build a fantastically valuable collection, but that's how it nearly always works out financially. They often began long before their interest was fashionable to a broader audience, they studied, bought quality things, bought wisely based on knowledge, bought always what they loved and were generous with their collections by sharing their creation. They also kept meticulous records much of the time.

Most great collectors never thought of themselves as investing in Chinese art, but simply buying and learning about objects that hit home with them on a personal level.

Thanks Peter for this blog. Your thoughts in words are more or less my exact same feelings about the matter. By the way: I hope that for you and all your followers 2021 will be a year when thinking about Asian art it will be in the same way as reflected here above.

Dr. Elze Luikens, the Netherlands.

Thank you Elze, glad you enjoyed it and that we share the same view. Best Peter

Thank you Peter for a well thought out and executed blog that could only have come from someone with many years experience in the business.

I’ll invest in the Dow Index Funds. Smile !

Love your ‘work’ Peter. Good advice.

I started collecting Chinese art when I found a nice Tang style carving of Yang Gui Fei playing the pippa in Lapis Lazuli.

I was a bit confused by the generous proportions of the player despite her Tang hair and dress and clearly Tang pippa (they changed over the centuries). I was forced to learn something, which of course increased my appreciation.

I started buying things which I was attracted to and felt were quality works.

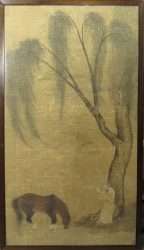

I picked up a beautiful scroll. A man fishing.

Another, a simple bamboo painting with text.

then a long hand scroll of a scene along a river.

I later started studying Chinese so I could decipher the early running script.

The man fishing was ‘Lord Jiang Taigong goes fishing as told by the ancients (without a hook)’ and the poem inscribed tells the story.

It is a wonderful painting and now I appreciate it more.

The ‘simple’ bamboo painting is a very large museum copy of Wen Tong’s Bamboo in monochrome ink, perhaps the ultimate bamboo.

The handscroll is a smaller copy of Along the River During The Quing Ming Festival by Zhang Zeduan.

The learning helped me more greatly appreciate the art and culture which created it and it appeared I had a bit of an eye for it.

I stick to ‘I like it. It’s well done. It’s affordable’.

Can’t go wrong.

Peter is a collector. He has collected enough knowledge to be hooked, without a hook. A little knowledge is a dangerous thing. A lot and your fate is sealed.